Longer lives and financial pressure mean many people believe that retiring in their 60s will become a thing of the past. So, if you want to ensure your child or grandchild can enjoy financial security later in life, how could you help them? Read on to find out.

Two-thirds of Brits believe retiring in your 60s will become a trend of the past

Most people planning for their retirement today, probably imagine themselves stepping away from work in their 60s. Indeed, according to the Office for National Statistics (ONS), in 2021 the average age of retirement for both men and women was 66.

Yet, that milestone could be decades later for younger generations.

A survey carried out by Canada Life found that 69% believe that retiring in your 60s will become a thing of the past. One of the biggest reasons for this is the expectation that we’ll live longer than previous generations. In fact, the median ideal age was found to be 90.

ONS figures highlight how growing life expectancy will affect the population of the UK. Between 2023 and 2050 the number of people aged 65 and above is expected to grow by just under 40%. Similarly, there is expected to be a 200% rise in the number of people who celebrate their 100th birthday during the same period.

Longer lives can present challenges, including the need to fund more years in retirement. So, it’s not surprising that two-thirds of people believe working for longer is the solution. Yet, that may not align with the goals or lifestyle aspirations of younger people.

If you’re worried about how your children or grandchildren are preparing for their retirement, even if it’s decades away, there may be some steps you can take.

How to help younger generations prepare for retirement

1. Encourage them to engage with their pension early

Retirement can seem like a milestone that’s too far away to concern yourself with when you’re starting your career. However, engaging with their pension early could mean loved ones have far more saved for retirement.

Pension contributions are typically invested so they have an opportunity to grow. As the money cannot be withdrawn, the returns are usually invested and may generate additional returns. This compounding effect means that small contributions at the start of a career could grow significantly.

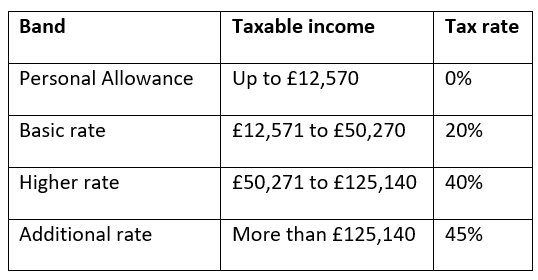

Assuming an annual investment return rate of 5% before fees are considered and a retirement age of 65, the below table highlights how compounding could affect the retirement savings of two workers.

Source: Legal & General

As you can see, person B contributes more than £8,000 extra to their pension, but as they’ve missed out on 18 years of compounding, the value of their pension is almost £60,000 lower when they retire.

So, if your child or grandchild has paused their pension contributions or opted out of their workplace scheme, encouraging them to reconsider their decision could put them on track for a retirement that offers greater financial security.

2. Contribute to their pension on their behalf

If you’d like to lend a helping hand, you could make contributions to your loved one’s pension. Their pension would benefit from an immediate boost and the potential investment returns might mean your initial gifts grow over the long term.

You may want to speak to your family member about the contributions that are already going into their pension, including those made by their employer, to avoid exceeding the Annual Allowance, which could trigger a tax charge.

In the 2024/25 tax year, the Annual Allowance is £60,000 for most people and pension contributions of up to 100% of the pension holder’s annual salary can benefit from tax relief. If the pension holder is a high earner or has already flexibly accessed their pension, their Annual Allowance may be lower.

Unused Annual Allowance may be carried forward from the previous three tax years.

Remember, money that is contributed to a pension isn’t accessible until the pension holder is 55 (rising to 57 in 2028). As a result, you might want to assess your own financial security and the effect a gift could have on it before you contribute to a pension on behalf of a family member.

3. Lend financial support to help them reach other goals

Financial pressures might mean your loved one is considering halting pension contributions. So, speaking to them about other challenges they might be facing could highlight where your support may allow them the financial security to start saving for retirement.

For example, younger family members may be struggling to pay rent and save a deposit to get on the property ladder. A gift from you to help them reach the milestone of homeownership might mean they’re in a better position to start regularly contributing to a pension.

Alternatively, day-to-day financial pressures may mean your child or grandchild is hesitant to place money into a pension that they wouldn’t be able to access until they reached retirement age. In this case, regular financial support that could be used to cover everyday costs might give them the confidence to place money in a pension.

Again, assessing your financial plan and the implications of handing over regular gifts could help you understand the effect it might have on your wealth in both the short and long term.

4. Consider your legacy now

As part of your legacy, your wealth could be used to help children or grandchildren secure financial freedom in retirement. Reviewing your estate plan now could highlight ways you could support this goal, including through gifting assets during your lifetime or leaving wealth after you’ve passed away.

While creating an estate plan, it’s important to keep in mind that things may change. For instance, if you need to pay for care later in life, the inheritance you leave for loved ones could be less than you expect.

5. Refer them to your financial adviser

While loved ones are accumulating wealth, they might think they wouldn’t benefit from working with a financial planner. Yet, it’s never too soon to start thinking about retirement or other long-term goals. In fact, working with a professional before they step back from work could present an opportunity to grow their wealth further and create a more comfortable retirement.

So, if your children or grandchildren aren’t working with a financial planner, introducing them to yours could help get their finances on track.

Get in touch to discuss how you could support loved ones

If you’d like to talk about your options for lending financial support to loved ones, including helping them prepare for retirement, please get in touch. We could work with you to help you balance your financial security and retirement goals with the aid you might want to provide family members.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

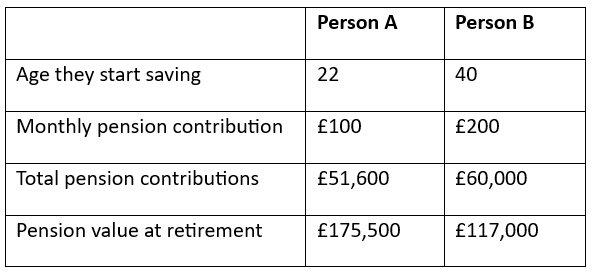

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.