Cash can be comforting. It’s familiar, it’s accessible, and it’s tangible. But while cash savings can be part of a well-balanced financial plan, they’re not always the best-performing asset.

Data shows that many UK adults are reluctant to depart from cash. In an update reported by MoneyWeek, the Financial Conduct Authority (FCA) reported that 61% of adults with £10,000 or more in investible assets are holding at least three-quarters in cash. 1 in 5 adults have cash savings of £25,000 or more, and around 1 in 10 have savings exceeding £50,000.

The regulator warned that holding such a large proportion of assets in cash could mean UK adults are missing out on the longer-term returns potentially available from investing, even when savings interest rates are high.

Read on to find out alternative options to cash, how to begin moving into other investments, and the times cash might be a more appropriate choice.

Global economic uncertainty saw more investors turning to cash, but history tells us markets do rally

Part of the appeal of cash currently can be attributed to market volatility that spooked investors in the early months of 2025, with President Trump’s tariff announcements causing widespread uncertainty.

According to a May 2025 report from MoneyAge, this caused a rise in the number of DIY investors – those who manage their own portfolio – turning to cash. Between February and April, 56% increased their exposure to cash, a 10% increase compared to investors who switched to cash after the 2024 Autumn Budget.

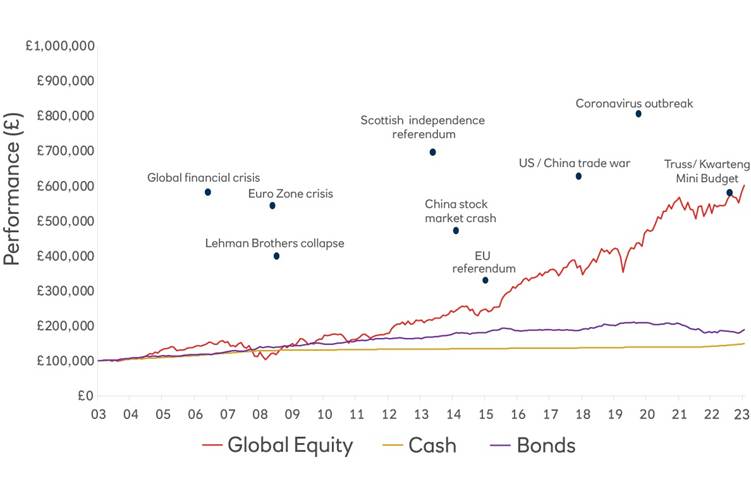

It’s understandable for you to want your wealth kept safe, and for global turbulence to drive you to think about cashing in. But history tells us that volatility is to be expected. While we can’t rely on past performance as an indicator for the future, we can also see that markets bounced back quickly from events such as the 2008 financial crisis, the pandemic, and the beginning of the conflict in Ukraine.

The below graph from NatWest covering the period between 2003 and 2023 highlights this, showing the return on global equities (shares), bonds, and cash at critical points in history. Although cash remains relatively level, the eventual returns from bonds and equities would have been higher.

Rising inflation could have a negative effect on your purchasing power

Inflation is always another key consideration with cash savings. Unless your savings interest rate is consistently above the rate of inflation, the real value of your money could remain the same, or even go down.

Ultimately, this could dent your purchasing power in the long term.

Consider this example. You have £100, which can buy £100 of goods and services today. If you save your money in a bank account with 1% interest, you’ll have £101 next year. But if inflation is 5%, those same goods and services will cost £105 next year. With £101, the money in the bank would no longer be enough to buy it – it has lost value in real terms.

Historically, shares and bonds have always outperformed cash. According to Vanguard, data from 1901 to 2024 shows that average annual returns after inflation were:

- 5.34% for global shares

- 1.36% for bonds

- 0.89% for cash.

So, you can see the argument for investing at least some of your wealth, helping it keep pace with the rising cost of living.

Considering your goals and risk approach can help design a suitable investment portfolio for you

Shifting some of your cash savings into investments could help you see better returns. But before you do this, the first thing to consider is your goals. For example, are you hoping to receive an income from your investments, or are you investing for long-term growth?

This can help you determine the right place for your wealth. You also need to consider your approach to risk: do you want a low-risk option that will pay out less, or a higher-risk alternative with potentially higher returns?

Talking with a financial planner can help you establish your own financial strategy, based on your aspirations, risk tolerance, and preferences. They can work with you to build a diverse portfolio, meaning that if you see losses in one area, these could be mitigated in others.

Some of the most common types of investments you could consider include:

- Stocks and shares. These are a stake in a company, and are traded on a stock exchange. The price of shares can go up or down.

- Bonds. Investing in a bond means you’re effectively lending money to a company or government, which they pay back at a fixed rate of interest. They’re a more stable investment than shares, but can be negatively impacted by interest rate fluctuations.

- Funds. Here, your money is invested along with other people’s to buy a range of assets, which can include shares and bonds, helping to diversify your investments. As they’re also spread across different markets and sectors, poor performance in one area can be offset by others.

There are other investment options, too, which a financial planner can talk through with you.

Cash is a good option for short-term goals and as an emergency fund

None of this is to say that cash is obsolete. Far from it, cash can be an important part of a well-balanced financial plan.

It’s a good idea to have a cash reserve in place as an “emergency fund”, which could be three to six months’ worth of your essential outgoings.

It can also make sense to save for short-term goals and purchases in cash savings. For example, if you’re saving for a holiday in a year’s time, you need to know that you’ve saved enough, without risk, and that it will be accessible when you need it.

Get in touch

Talk to us about how to strike the right asset balance, including cash, for your wealth portfolio.

Please note:

This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.